MR990 million chasing after bad money

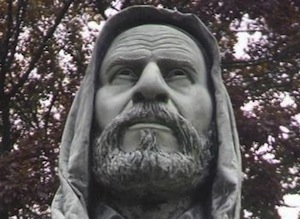

Umar Mukhtar

Let me tell you a story. A true story no less. Anybody who wants to dispute it, please sue me.

There is a company with only a million ringgit paid-up capital supposedly own by us. It went out to borrow money. The first few billion ringgit was fully guaranteed by us. It’s okay it’s our strategic investment company. But then it went out internationally to borrow some more.

This time, borrowing without our guarantee but with our Comfort-Letter. The probable difference between this Comfort-Letter and a guarantee is that if the company can’t pay the loan, the lenders cannot immediately recover from us like with a guarantee. The company would try to raise more money up to selling its assets until bankrupt. If still cannot pay, then we have to top-up, otherwise we will be pariahs in the world financial markets.

Because of the weaker borrowing power, the company’s borrowings are characterised by:-

1. Very high interest rates.

2. Very high facilitator costs

And so it went on and on and on for 6 years until the total of the company’s debts is maybe MR52,000 million.

What did the company buy with the borrowed money. It went on a buying spree up to roughly MR47,000 million of assets, such as power stations, land, etc., its purchase is characterised by:-

1. Paying inflated prices for open market assets making some people laughed all the way to the banks.

2. Paying giveaway prices for government assets which were not available to other possible buyers.

For up till to at least 6 years, the company’s Balance Sheet now reads something like MR52,000 million in borrowings and MR58,000 million in assets. Wow! The ignorant company’s apologists started to worship the company’s management.

After all, only 6 years operating and the company had amassed at least MR6,000 million or averaging MR1,000 million a year in excess assets. Isn’t that brilliant or what! And without a single sen of organic revenue of its making.

Makes you wonder why it can’t pay its loan interests. And where did it get the MR6,000 million without doing any business except for a few ringgit here and there from ongoing businesses that it had bought.

It’s called REVALUATION. Remember those assets bought from the government at giveaway below market prices, even though any professional valuer would value them higher at points of sale. Immediately those assets were revalued and revalued and revalued by thousands of millions of ringgit. Hence, the healthy Balance Sheet that Ahmad Mazlan screamed about.

Alas, you can’t pay the lenders with paper figures. They were promised cold hard cash. So the company had to borrow hard cash here and there, if allowed, from Ah Longs and Chettiars.

Then it did something that it’s apologists said we needn’t worry about when the story of the company first came out. IT WAS RECENTLY BAILED OUT BY US to the tune of MR990 million? Sure it is ONLY MR990 million. The first time is always the most difficult. If you call a presentation by management and its Public Auditors sufficient to certify the health of this company by our trustees, the Cabinet, as difficult!. After this, God knows.

Why did we have to bail it out? Cash-flow problems, the assets have not matured and public investments have no chance to come in yet. As if we will break the door to invest with our money managed by these third-rate managers. The ones whose arms will be twisted to invest will be EPF, LTAT, TABUNG HAJI, the Pension Fund etc. Our money again, which are under their charge again.

I am not even delving into possible frauds. Just plain STUPIDITY. Don’t accuse me of pre-judging sincerity.

It will never be enough. Soon the company will come up with a sophisticated and respectable term to raise money. It’s called MONEYTISING it’s assets. Don’t be fooled by the term, it simply means sell the house, the sofa and the dog etc. Almost a controlled fire-sale.

The significance of this is that if before not everybody can buy these strategic assets, now who makes the highest offer gets them. Monetise. Parcels here and parcels there. Makes you wonder why we didn’t do that in the first instance? At least we could have gotten their true worth.

The name of that company is 1 MALAYSIA DEVELOPMENT BERHAD and the name of the apologist group is UNITED MALAYS NATIONAL ORGANISATION and the silent partners are BARISAN NASIONAL. You know what to do whenever you can stand up and be counted.

By the way, the MR990 million we may have just given away could rebuild all the houses damaged by the recent floods and some. Complete with flood mitigation schemes and without the painful photo-ops.

Do you have a happier story about this company? I long for one. No fairy tales, fables or wishful thinking though!