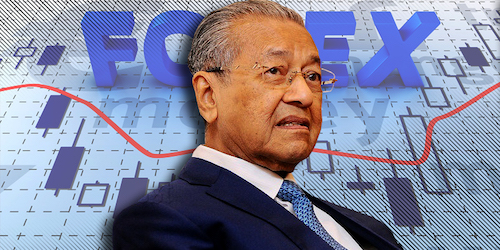

Bank Negara forex scandal: orders came from the top

(FMT) – A former senior officer with the auditor-general’s department told the Royal Commission of Inquiry that the Attorney-General’s Chambers (AGC) refused to give written advice that Bank Negara Malaysia’s (BNM) involvement in foreign exchange (forex) trading was unlawful.

P Kanason said on further inquiry, then AGC head of advisory services Ainum Mohd Saaid informed him that “orders came from above not to interfere”.

The witness, who was assistant auditor-general for all Federal and state statutory bodies, including BNM, said his boss “blew his top” when told about the matter.

Kanason, who opted for early retirement in January 1992, said BNM was heavily involved in buying and selling foreign currencies and it was not up to auditors to decide on the interpretation of the law.

“This finding was discussed with BNM officers but there was no response. It was decided to seek assistance from the AGC,” said Kanason, who is the seventh witness called by the RCI on the losses suffered by BNM due to forex trading in the 1990s.

He said the auditor-general’s department asked for legal advice sometime in 1990 whether the trading in foreign exchange by BNM was in compliance with Section 31 (a) of the Central Bank of Malaysia Act 1958.

Kanason said Ainum gave verbal advice across the table that such forex trading was not in compliance with the law and that a written reply would be supplied in due course.

“This development was reported to the then auditor-general. Days passed without the expected written advice and I thought I should inquire,” he said, referring to his former boss Ishak Tadin.

Kanason said he rang up Ainum and she simply replied: “Orang atasan cakap jangan campor tangan.” This translates to “Orders came from above not to interfere”.

He said he did not ask who was the “orang atasan” being referred to and neither did she volunteer the information on her own.

Kanason said in early 1993, after his retirement, Ishak (Tadin) told him that BNM had lost a great deal of money but did not tell him how much.

“Based on my audit, I am not aware of any forex trading losses by BNM prior to 1991,” he said.

Kanason said a situation of BNM getting involved in illegal forex trading activities without the support of the AGC must never happen again.