Once and for all, was money ever stolen from 1MDB?

“Well, it tells you that the guys at Abu Dhabi finally conceded that money, if indeed stolen, was stolen from the BVI Aabar and not 1MDB. It also tells you that the GoM fell victim to a fraud scheme involving a former IPIC MD who misled the Malaysian wealth fund. But most importantly, it tells you that the Lim Kit Siang led Malaysian opposition and the old wrinkled prune himself are nothing but shxtheads and axxholes”

THE THIRD FORCE

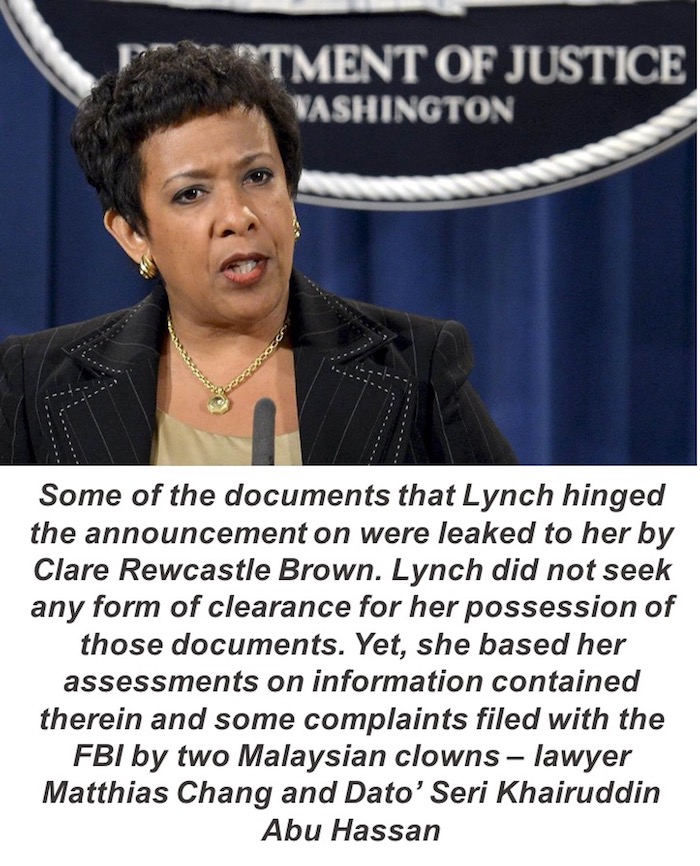

On the 20th of July 2016, former United States (US) Attorney-General Loretta Lynch announced the filing of civil forfeiture proceedings by the Department of Justice (DoJ) to recover more than USD1 billion in assets allegedly purchased using stolen 1MDB funds. Some months later, The Third Force undertook to expose a multifaceted complicity led by billionaire-anarchist George Soros and former British premier Tony Blair to effect a regime change in Malaysia by sabotaging the wealth fund. It was thereafter assumed that Malaysians understood precisely why the announcement by Lynch was nothing but a sham.

I assumed everyone understood that.

However, due to recent attempts by the DoJ to impress upon you that Dato’ Seri Najib Tun Razak conspired with billionaire Jho Low to defraud taxpayers, I have taken it upon myself to retell the whole 1MDB saga to put things into their proper perspectives. To kick things off, let us ask ourselves the billion-dollar question that the DAP is trying hard to re-politicise ahead of the upcoming general election (GE14):

Was money ever stolen from 1MDB?

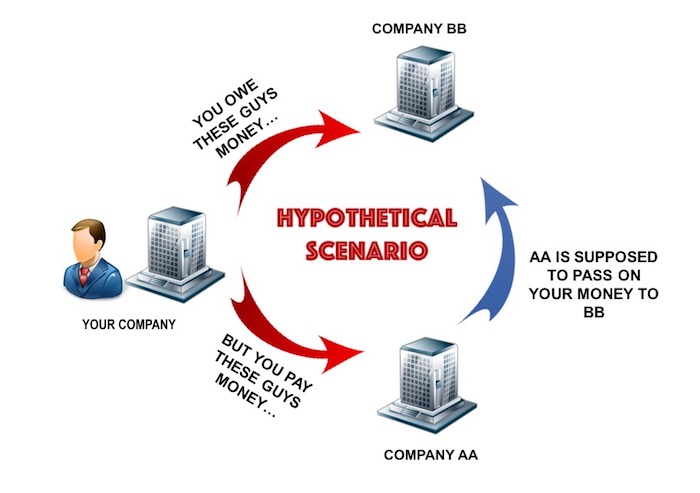

Well, let’s start by considering a hypothetical scenario. Let us suppose that you own a company – whatever the name may be – that issued some payments to AA Sdn Bhd. Let us further suppose that the sums you remitted to AA were to fulfil your obligations to its parent company, BB Sdn Bhd. Finally, let’s assume that you remitted the sums to AA and not BB because the directors of BB instructed you to channel the money through its subsidiary and not directly to it.

Clear?

Now, what if the directors of BB were to suddenly turn around and accuse you of failing to fulfil your obligations? Under the circumstances, you will need documentation to prove three things – first, that you did indeed remit the said sums to AA, second, that you undertook in an agreement with BB to do so, and third, that AA is indeed a subsidiary of BB. Fulfilling these conditions, you would have legitimate grounds to reason that you fulfilled your obligations pursuant to the terms of agreements you had with BB.

If, however, the guys at BB still accuse you of non-compliance, they either suspect you misled them or are themselves misleading you. Assuming that the matter ends in litigation, it would be up to the courts to decide (among others) if or not the money you remitted to AA was stolen or if BB was playing you out. However, should the matter be settled out of court, it would then fall upon you and BB to decide how best to account for the missing sum.

Whichever the case, until and unless the matter is resolved, the money would technically be classified as the subject of dispute and not stolen funds.

Is that what happened in the case of 1MDB?

Only to some extent.

In the case of 1MDB, money was remitted to Aabar Investments PJS Limited, a British Virgin Islands (BVI) concern that the board of the Malaysian wealth fund was told is a subsidiary of the Abu Dhabi based International Petroleum Investment Company (IPIC). One of the persons who communicated the payment terms and entered an agreement with 1MDB was Khadem Al-Qubaisi, who, at the time of payment, was the Managing Director (MD) of IPIC.

As it turned out, Khadem was also the director of the BVI company that received the said payments from 1MDB. Both the Malaysian wealth fund and the Ministry of Finance (MoF) have proof of payments made to the BVI Aabar and compelling reasons to suggest that Khadem was the common denominator to both the BVI and the Abu Dhabi concerns.

Now, the money that 1MDB remitted to the BVI entity was to fulfil its obligations pursuant to the terms of some agreements it had with IPIC. It was only when IPIC announced that it hadn’t received the money did the Malaysian wealth fund realise that it had been conned. It was later discovered that the BVI Aabar was a bogus entity which Khadem had intentionally used to mislead the Government of Malaysia (GoM).