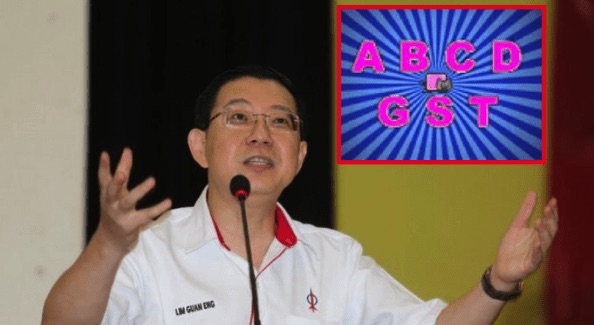

Guan Eng caught lying again

And this is why the Chinese are the most vocal in opposing the GST. And this is why 98% of the Chinese voted Pakatan Harapan — because they are angry about the GST. And this is why Pakatan Harapan abolished the GST — to make the Chinese happy. But the cost of living has still not gone down. So, to the Malays, it is still life as usual.

NO HOLDS BARRED

Raja Petra Kamarudin

Tun Dr Mahathir Mohamad proudly announced that 90% of the personal income tax which the government collects are paid by the Chinese. If that is so then the spending power is in the hands of the Chinese and not in the hands of the Malays, Indians, Bumiputeras and ‘others’.

According to the Treasury, 70% of the personal income tax is paid by salaried employees while the businessmen and self-employed contribute to only 30% of the personal income tax. If the Treasury is able to collect all the personal income tax due, then the salaried employees would be paying just 10% of the personal income tax collected while businessmen and self-employed would be contributing 90%.

So, in spite of the high tax evasion by the businessmen and self-employed who pay only a fraction of what they should, the Chinese still pay 90% of the personal income tax that the government collects.

The Chinese are those most affected by the GST

What does this tell you? It tells you that only a few people are paying personal income tax and the government collects a fraction of what it should. Only 2.27 million registered workers out of 14.6 million pay personal income tax.

Yes, only 2.27 million out of 14.6 million Malaysians pay income tax. But with the GST everyone pays. PwC International Assignment Services Sdn Bhd executive director Hilda Liow said, “The GST is a fairer tax regime compared with direct income taxes. It’s a consumption tax — if you don’t spend, you don’t pay.”

So, there you have it. Without GST only 7% of Malaysians pay tax. With GST no one is exempted. And the more money you spend the more tax you pay. And those who have money to spend are those who pay 90% personal income tax but who do not pay what they really should be paying.

Even in the UK the Chinese spending power is bigger than the locals

In other words, based on what Mahathir says, the Chinese are those most affected by the GST. So what Guan Eng said (which you can read below), that the GST impacts the poor, is a lie. The GST impacts those who evade tax but now have to pay tax. And that would be the businessmen and self-employed.

And this is why the Chinese are the most vocal in opposing the GST. And this is why 98% of the Chinese voted Pakatan Harapan — because they are angry about the GST. And this is why Pakatan Harapan abolished the GST — to make the Chinese happy. But the cost of living has still not gone down. So, to the Malays, it is still life as usual.

*******************************************************************************

GST impacted the poor, says Guan Eng

(The Star) – The Goods and Services Tax (GST) impacted all Malaysians, including the poor for the first time as they never had to pay taxes previously, claims Lim Guan Eng (pic).

The Finance Minister said the GST imposed a heavy financial burden on the ordinary rakyat until they felt compelled to change the government for the first time in 61 years.

He was responding to former prime minister Datuk Seri Najib Tun Razak who had claimed that the GST was only for the rich and with its abolition, only the rich and business people would benefit the most.

“The new Malaysia Baru Government had delivered on our promise to abolish the GST. Warnings by the previous government that Malaysia would go bankrupt without the GST did not materialise.

“Not only did the Government not go bankrupt, but BR1M (renamed as Bantuan Saraan Hidup or BSH) payments were continued even without the GST. BSH is targeted at helping the B40 group,” he said in a statement on Sunday (Aug 12).

Lim asked how Najib could claim that the poor are not being helped when the final BSH payment is to be made beginning Aug 15, a week before Hari Raya Aidiladha.

Some 4.1 million recipients will be receiving the BSH involving an estimated cost of RM1.6bil.

He added that the B40 group were further assisted when the Pakatan Harapan Government stabilised the RON95 petrol prices although oil prices went up from the 2018 budget estimate of US$52 per barrel to US$74 per barrel.

He said the fuel subsidy costs RM3bil until the end of the year.