Malaysia Cannot Escape From China — It’s Too Late

Mahathir’s decision to revive the Iskandar Waterfront Holdings and China Railway Engineering Corp (CREC) came a few hours after he oversaw the signing of agreements on currency swaps and plans to raise imports of Malaysian frozen durian and palm oil.

Panos Mourdoukoutas, FORBES

Malaysia is already caught in China’s web, and there’s no escape from it. The best it can do is to bring Beijing to the negotiating table, and try to get better deals for projects under way.

In the early days after his election, Malaysia’s Prime Minister Mahathir Mohamad sent a strong message to Beijing about his will and determination to control the destiny of Malaysia by canceling high profile Chinese projects in the country.

Apparently, he wanted Malaysia to avoid China’s debt trap, which has left other countries with no choice but to cede control of indebted projects to Beijing.

Then he took his message on a roadshow, advising the Philippines President Rodrigo Duterte to avoid China’s “debt trap.”

The trouble is that Mahathir’s revolt against China didn’t last long. And now the best it could accomplish is to bring Beijing back to the negotiating table to cut the cost of the investment projects assigned to Chinese contractors.

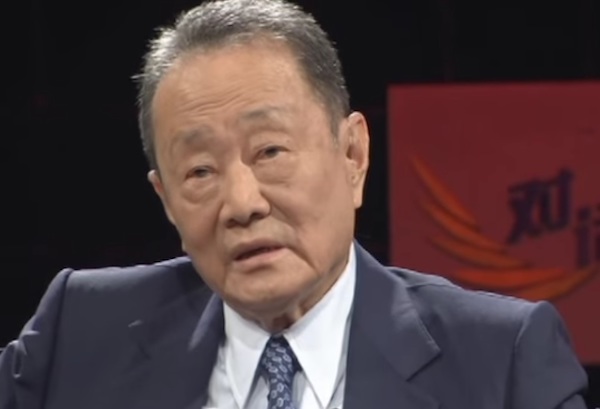

Robert Kuok, Mahathir’s link to China

READ MORE HERE

1. Robert Kuok Adalah Agen China

2. Najib Punya Susu, Mahathir Dapat Nama

3. Beli Kedai Roti, Dapat Satu Bandar

4. Terdedah: Perjanjian Rahsia Projek ECRL Melibatkan Ribuan Hektar Tanah Diberi Ke China

5. Pakatan Harapan’s “Get-Robert-Kuok-Rich-Quick” Scheme

Last week, China agreed to cut the cost of East Coast Rail Link project by one-third. This week, the two countries have agreed to revive the Bandar Malaysia project with the original contractors — a joint-venture between Malaysian firm Iskandar Waterfront Holdings and China Railway Engineering Corp (CREC) – with some modifications. Like the construction of 10,000 affordable housing units, and the use of local sources.

What made Malaysia soften its tone on China? A couple of things, in my opinion. One of them is that there’s a great deal of “sunken” costs for the projects under way; and it will be hard to find alternative sources of financing to proceed with them.

Then there’s Malaysia’s reliance on China for its exports. Last year, China was the largest export market for Malaysia ($42.5B), followed by Singapore (35.7B), and the US ($33.1B); and that gives Beijing great leverage against any “irrational” behaviour by Malaysia.

By coincidence, Malaysia’s exports dropped unexpectedly lately, down 5.3% annually to MYR 66.6 billion in February 2019, after a 3.1% in January and missing market consensus of a 1.4%, according to Tradingeconomics.com. Sales dropped for palm oil & palm oil-based products (-13.4% to MYR 4.7 billion); refined petroleum products (-30.9% to MYR 3.6 billion); crude petroleum (-21.8% to MYR 1.9 billion); timber & timber-based products (-1.7% to MYR 1.4 billion) and natural rubber (-23.1% to MYR 0.2 billion).

Meanwhile, Mahathir’s decision to revive the Iskandar Waterfront Holdings and China Railway Engineering Corp (CREC) came a few hours after he oversaw the signing of agreements on currency swaps and plans to raise imports of Malaysian frozen durian and palm oil.

Another coincidence?