Move over, ‘Made in China’. It’s the ‘Made in Bangladesh’ era now

Soaring wages at home have seen many Chinese firms set up shop in Bangladesh, boosting its economic growth, expected at 8 per cent this year. But while there has been a backlash against Chinese investments and workers in the Philippines and Indonesia, Dhaka is more welcoming.

(SCMP) – When Chinese businessman Leo Zhuang Lifeng arrived in Dhaka 22 years ago, only one of the two luggage conveyor belts in the airport was functioning. The lighting wasn’t working properly, either.

The rundown airport in the capital of Bangladesh prepared many Chinese and foreign businessmen for what they were about to experience in the country, which was still an economic backwater at the time, with frequent power outages and inadequate infrastructure.

Zhuang, now 51, landed in Dhaka in 1997 to set up garment factories there, taking advantage of the low labour costs and abundant supply of workers. “Back then, there was a lack of daily commodities. It was not even easy to buy instant noodles,” said Zhuang, managing director of the LDC Group, which now employs about 20,000 workers in the country.

“But Bangladesh has gone through tremendous changes over the years, though of course you cannot compare those changes to what China has experienced.”

His factory compounds were so big they resembled villages on their own. There were medical centres providing free consultation for staff and their family members, as well as day-care centres for their children.

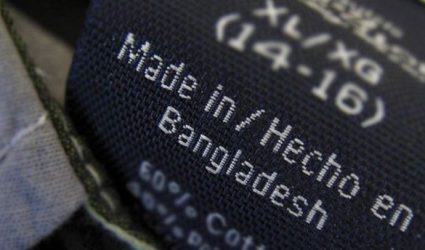

Such compounds are now everywhere in Bangladesh, as Chinese and other foreign investors have kept coming. This investment has transformed the country into a manufacturing powerhouse with 3.5 million labourers making clothing for local and international brands such as Uniqlo and H&M. Luxury brands such as Michael Kors also have some products made in Bangladesh.

As wages soar in China, more clothing is expected to carry the tag “Made in Bangladesh” rather than “Made in China” in the years to come.

Zhuang, now the president of the Overseas Chinese Association in Bangladesh, estimated there were only 20 to 30 Chinese companies in Bangladesh 22 years ago. By his estimate, that number has since grown to roughly 400 in the relatively young South Asian country, which gained independence from Pakistan in 1971.

Chinese loans have boosted Bangladesh’s economic growth. For about a decade, it grew at an average of 6 per cent, but is expected to hit 8.13 per cent this year, making the country one of the fastest-growing economies in the world.

Bangladesh’s ability to achieve such fast and stable economic growth over the years has raised eyebrows. In interviews, however, Bangladesh’s Minister of State for Foreign Affairs Mohammed Shahriar Alam as well as Information Minister

Dr Hasan Mahmud said the administration was able to handle the debt because the economy was strong.

The information minister also made it clear Dhaka did not want to become dependent on any country, and his administration would befriend any country extending their support to Bangladesh’s development. “We have a wonderful economic relationship with India,” he said, pointing to the billions of dollars in loans India has granted Bangladesh. “Your question is whether we will be able to pay back the (Chinese) loans. No worries for Bangladesh.”

Analysts say Dhaka has avoided the so-called Chinese debt trap because while it cosies up to China, it continues to seek economic partnerships with other countries, in particular India.

FROM CHINA TO BANGLADESH

Despite its rapid economic growth, Dhaka remains different from other Asian capitals such as Jakarta, Manila and Phnom Penh. Its infrastructure, including highways, is lacking; during peak hours, there is so much traffic that it can take three frustrating hours to navigate a distance of 50km.

But Bangladesh’s ample room for development is precisely why it has drawn so many investors. Among them is Hong Kong businessman Felix Chang Yoe-chong, chairman of the Hong Kong-listed Evergreen Products Group, one of the largest wig manufacturers in the world.

Since moving his factories from mainland China to Bangladesh, he now has 18,000 workers who produce 300,000 to 400,000 wigs a month in the Uttara Export Processing Zone, an hour’s flight from Dhaka.

Some 20 companies, among them about six from Hong Kong, have set up factories in the 213-acre zone. There are eight such zones across Bangladesh, allowing companies to import materials needed to make their products at a reduced or zero tax rate. This concessionary tax policy applies to their exports as well.

Like many entrepreneurs from Hong Kong and mainland China who set up factories in Bangladesh, Chang, 53, did so 10 years ago because of rapidly rising labour costs on the mainland. “I had to move my factories to somewhere in Asia. It was not just the wages, the social welfare benefits we needed to give our workers in the mainland were rising as well,” he said.

A decade ago, Chang’s company had factories in the Chinese cities of Shenzhen, Guangzhou and Kunming, as well as in Henan province. He has shut the Guangzhou factory and drastically scaled down the other Chinese factories. Now, 93 per cent of his company’s wigs are manufactured in Bangladesh.

Before Chang moved his factories there, he was paying his Chinese workers about 2,000 yuan (US$289) a month. Soon after the relocation, he was paying local employees the monthly minimum wage of just 170 yuan, or US$25.

The minimum wage in Bangladesh currently is US$95 a month, which is still lower than those in other Asian countries. It is US$182 a month in Cambodia; US$180 a month in Hanoi and Ho Chi Minh City, though lower in other Vietnamese cities; and US$3.60 per day in Myanmar.

While low wages have made the garment sector a US$30 billion industry that accounts for 80 per cent of Bangladesh’s exports, workers in the South Asian nation are less than pleased with their income. In January, thousands took to the streets to demand an increase in the minimum wage. Dozens were injured during clashes with the police and one was killed.

Zhuang from the LDC Group – which had factories in Gazipur city, a drive of about two hours from Dhaka – said a problem with setting up factories in Cambodia was that the country had strong unions and a small population of just 16 million. By comparison, Bangladesh’s population is 160 million.

He also said he was not in favour of Vietnam because production costs and wages were rising fast. “Corruption in Cambodia is common. The population is small and the unions are powerful,” Zhuang said.

Despite the huge increase in the number of Chinese companies since Zhuang arrived in Bangladesh 22 years ago, their presence is still relatively small compared with countries such as the Philippines and Indonesia, where Chinese workers and businessmen are easily seen in the capitals.

While the Chinese influx has caused uneasiness and anger in those countries, such sentiment has not – at least not yet – emerged in Bangladesh.

INSUFFICIENT INFRASTRUCTURE

It was the summer rainy season when Chang of Evergreen Products first arrived in Bangladesh a decade ago.

“There were heavy rains so Dhaka was flooded. The water was so high the wheels of my vehicle were completely submerged in water,” he recalled.

“The electricity was really bad. There were always power outages in my Dhaka office every time I came. It lasted for an hour each time. But there were almost no outages in recent years. The roads are now being widened. Highways and flyovers are also being built.”

During Chang’s first few years in the country, there was no flight from Dhaka to where his factories were located. Even though there was an airport, it was not open because hardly anyone was using it. It meant that every time he had to go to his factories, he had to travel over land for nine to 12 hours, depending on traffic conditions.

In a sign of how much has changed, there are now several flights to his factories in the Uttara zone every day.

A major problem investors face is the time it takes to have their goods shipped to overseas clients. The Chittagong port, the main port in Southeast Bangladesh, handled about 2.56 million 20-foot equivalent units (TEUs) of container cargo in 2017, more than its designed annual capacity of 1.7 million TEUs a year.

The port also cannot handle large container ships because of its narrowness. This meant getting materials shipped from mainland China or Hong Kong to Bangladesh took four to five weeks, Chang said.

“A friend of mine who has a handbag factory here opened a factory in Cambodia two to three years ago. He has 4,000 workers in his Bangladesh factory. He told me that it took only 10 days to have materials shipped from China to Cambodia. That was so fast,” Chang said.

“The advantage of doing business in Bangladesh is that the wage is low. The downside is that shipping takes a long time. But for me, a solution is to have more wig materials stored in the factories.”

Hongkonger David Lam Ming-heung, general manager of an eyeglass manufacturer in the same export zone, understands the logistics troubles all too well.

It usually took a month to have materials shipped from mainland China to Bangladesh, he said, adding that it could take an extra week if there were no available berths.

“Bangladesh right now is like China when China was first opening up [in the 1970s],” said Lam, 53, who oversees 3,700 workers in the factory. “Bangladesh is using the China model to grow its economy.”

A FRIEND TO ALL

Beijing’s support of Bangladesh was evident in the 27 agreements for investments and loans signed by the two countries – amounting to a reported US$24 billion – when President Xi Jinping visited in 2016.

Net foreign direct investment from China into Bangladesh exploded after Xi’s visit. It reached US$506 million in the 2017/2018 financial year, according to the Bangladeshi newspaper The Financial Express , a substantial increase from US$68.5 million in 2016/2017.

Chen Wei, deputy chief of mission at China’s embassy in Dhaka, declined to say what proportion of loans made up the deals signed in 2016. But he stressed that concerns about China creating a debt trap for Bangladesh were a “total misunderstanding” and “smears” that were “totally groundless”.

Professor Brahma Chellaney, from New Delhi’s Centre of Policy Research, estimates that Bangladesh’s public medium- and long-term debt is equivalent to about 14 per cent of its gross domestic product. “This level of debt is moderate.

[Bangladesh] wants to ensure that its debt level remains manageable. So it wants to implement Chinese-financed projects in a way that undergirds its prudent approach,” he said, adding that Sri Lanka’s controversial deal signing over the operations of its Hambantota port to China for 99 years served as a “wake-up call to Bangladesh to avoid slipping into a Chinese debt trap”.

Chellaney added that Bangladesh had relied on assistance from not just China, but also India, Japan and South Korea

to power its economy. “Despite China’s enlarging footprint in Bangladesh, Indian and Japanese assistance and investment remain critical. Bangladesh wishes to sustain its impressive economic growth by cooperating with all powers, without choosing one over another,” he said.

Professor David Lewis, author of Bangladesh: Politics, Economy and Civil Society , said the country’s economy was strong because of its effective export strategy. “It has grown fast on the back of these exports, chiefly the ready-made garment sector, which has been central to the country’s growth,” said the academic from the London School of Economics and Political Science.

“Also important have been international remittances in part arising from its very enterprising people, but also from well-managed migration policies. Also, it’s important to note that Bangladesh has benefited indirectly from India’s successful economy.”

Bangladesh, the second-largest exporter of clothing after China, is expected to export US$39 billion of clothing this year. The government wants the figure to hit US$50 billion in 2021.

Alam, the Minister of State for Foreign Affairs, said his administration had been looking at other financing models rather than just borrowing from other countries. He said it was contemplating a public-private partnership under which, for example, a foreign company would build a power plant, sell the electricity produced to recoup its cost, and then turn over the plant’s ownership to the government after some years.

Last year, Bangladesh fulfilled the United Nations criteria to graduate from being a “least developed country” to a “developing country”.

Mehdi Hasan, Bangladesh’s consul general to Hong Kong, said China would be one of the major forces to help Bangladesh achieve its goal of becoming a developed country by 2041. “An attraction is the cost of labour. It’s the lowest in Bangladesh. It’s becoming higher even in Vietnam … There are 160 million people in Bangladesh, 57 per cent of the population is below 25 years old. The population is young.”

HOME AWAY FROM HOME

Some 2,300km from his home province of Hunan, Thomas Zou Haibo is a shadow of his former self. Since the assistant manager of a handbag factory started working in the Uttara zone seven years ago, his weight dropped from 90kg to just 70kg.

“I was one of the seven people who were sent here by my company seven years ago. When I first came, there was only 2G internet here and we could not get any Chinese television channels. There was no entertainment. It was just work every day,” said Zou, 33.

The hundreds of Chinese working in the companies in the export zone were close knit. Many of them lived in the same buildings, sharing meals and singing karaoke in their flats over the weekend. That was the closest to a Chinatown

in the zone.

“After all these years working here, I have developed a sense of belonging with the people here,” Zou said. “But I do miss home. That’s why I go home two to three times a year.”

David Zhao Zhiwen, manager of a toy factory in the zone, misses his two children. He oversees 4,200 workers who make 12 million toy models a year. His day starts at 7am and ends 12 hours later; he supervises every procedure, from the melting of metals to the moulding of the toys.

When Zhao, now 39, came to Bangladesh seven years ago to set up a factory in the Uttara zone, the area was a quiet village with mostly small bamboo houses on the two sides of the road. The zone has since given the area a total facelift, with about 30,000 workers employed there now.

“I came here to make money and provide a better quality of life for my family. I go back home [to Hunan] three times a year and stay there for 10 days each time. It’s worth coming here to work,” said Zhao, whose family does not live with him in Bangladesh.

There are about 100 Chinese employees at Zhao’s factory, mostly managers and technicians. “We need Chinese here to teach and pass on our techniques to the Bangladeshi workers,” he said.

In contrast to the backlash that has erupted in the Philippines and Indonesia, Bangladeshis and politicians in the country have been supportive of Chinese investors and workers. Muhammad Shafiqur Rahman, a member of the Bangladesh parliament, is one of them.

“We welcome everyone from every country in the world … Chinese people are already here in the whole country. If you visit our markets, shopping malls, you see a lot of things that are made in China. Chinese investment is helping the country.”

Farhan Haq, a law lecturer at the Central Women’s University in Dhaka, said: “Infrastructure is being built in the country. A lot of Chinese are here, investors and workers. They have created a lot of opportunities for the locals. We are not concerned. We are happy. They are helping the economy.”