Asia-Pacific closes in on world’s biggest trade deal

(CNA) – Fifteen Asia-Pacific economies are set to conclude talks on Sunday (Nov 15) and sign what could become the world’s largest free trade agreement, covering nearly a third of the global population and about 30 per cent of its global gross domestic product.

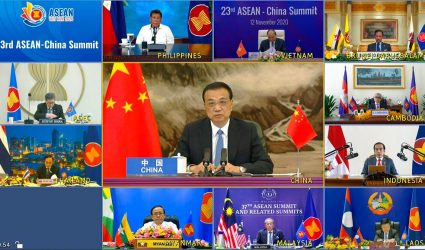

The Regional Comprehensive Economic Partnership (RCEP), which could be approved at the end of a four-day ASEAN summit in Hanoi, will progressively lower tariffs and aims to counter protectionism, boost investment and allow freer movement of goods within the region.

A US-China trade war and US President Donald Trump’s America First retreat from predecessor Barack Obama’s “pivot” towards Asia has given impetus to complete RCEP, which is widely seen as Beijing’s chance to set the regional trade agenda in Washington’s absence.

The US election win by Democrat Joe Biden, however, could challenge that, with the former vice president signalling a return to stronger US multilateralism.

WHAT IS RCEP ALL ABOUT?

RCEP includes China, Japan, South Korea, Australia, New Zealand and the 10 members of the Association of South East Asian Nations (ASEAN) – Brunei, Vietnam, Laos, Cambodia, Thailand, Myanmar, Malaysia, Singapore, Indonesia and the Philippines.

India was involved in earlier discussions but opted out last year.

One of the deal’s biggest draws is that its members already have various bilateral or multilateral agreements in place, so RCEP builds on those foundations.

It will allow for one set of rules of origin to qualify for tariffs reduction with other RCEP members. A common set of regulations mean less procedures and easier movement of goods.

This encourages multinational firms to invest more in the region, including building supply chains and distribution hubs.

WHAT IS ITS GEOPOLITICAL SIGNIFICANCE?

The idea of RCEP was hatched in 2012 and was seen as a way for China, the region’s biggest importer and exporter, to counter growing US influence in the Asia-Pacific under Obama.

Negotiations for a US-led “mega-regional accord” then known as the Trans-Pacific Partnership (TPP) – Obama’s signature trade deal – were making strong progress and China was not among its 12 members.

Momentum behind RCEP grew when Trump withdrew the United States from the TPP in 2017, taking away its main architect and two-thirds of the bloc’s combined US$27 trillion GDP. It was renamed the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and it includes seven RCEP members.

As the key source of imports and main export destination for most RCEP members, China stands to benefit and is well positioned to shape the trade rules and expand its influence in the Asia-Pacific, which Obama had openly sought to prevent.

HOW IS RCEP DIFFERENT TO CPTPP?

RCEP focuses heavily on slashing tariffs and increasing market access but it does not harmonise to the same extent as CPTPP and is seen as less comprehensive.

It requires fewer political or economic concessions compared with CPTPP and RCEP has less emphasis on labour rights, environmental and intellectual property protections and dispute resolution mechanisms, although it does include provisions on competition.

RCEP’s market size is nearly five times greater than that of the CPTPP, with almost double its annual trade value and combined GDP.

WILL A BIDEN PRESIDENCY CHANGE ANYTHING?

Biden is signalling a swing back to the multilateral approach of the Obama administration, but it might be premature to talk about trade deals given the huge challenges awaiting him on the domestic front, and risk of upsetting unions that helped get him elected.

His trade priorities are expected to focus on working with allies to jointly exert pressure on China over trade and to push for changes at the World Trade Organization. Rejoining the CPTPP in its current form might not be on the horizon soon.

The trade unions and progressives that backed Biden’s election have previously been sceptical about free trade agreements. He has included elements of those in his transition team and may be advised to maintain protections on vulnerable industries like steel and aluminium.

However, indications of Biden’s intent to reconnect in the Asia-Pacific would be broadly welcomed, including as a counterbalance against China.